E-Commerce

What you need to know

ECommerce is a safe way to transact. It is one of the most secure environments to purchase and pay for goods and services and one of the fast-growing sales environments in the United States.

“ACCORDING TO THE MOST RECENT CENSUS DATA, UNITED STATES ONLINE RETAIL SALES SURPASSED $1 TRILLION FOR THE FIRST TIME IN 2022 AND REPRESENTED A 7.7 PERCENT INCREASE OVER 2021. TODAY, ONLINE RETAIL SALES REPRESENT 14.6 PERCENT OF ALL RETAIL TRANSACTIONS IN THE UNITED STATES.”

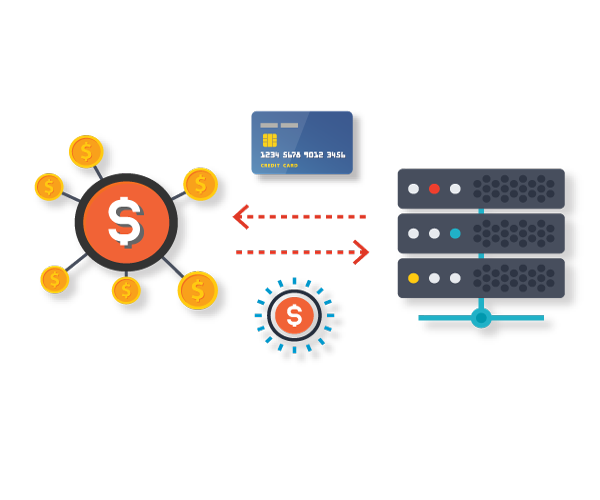

How do payments work in the eCommerce environment?

What types of payments are considered eCommerce payments?

Payments that are initiated through an online web browser via a specific retail website, browser-based payments from a tablet or smartphone, and smartphone payments that are initiated through a mobile app are all examples of eCommerce transactions. Sometimes the last example is referred to as an mCommerce, or mobile commerce, transaction.

“Online transactions can take longer because there are several additional steps the payment ecosystem goes through, including fraud algorithms.”

Why do online payments take longer to process?

In brick-and-mortar stores, payment transactions take a mere three to four-tenths of a second because the cardholder and card are present for the interaction. Online transactions can take longer because there are several additional steps the Payment ecosystem The current state of the payments infrastructure in the United States. goes through to account for the card not present (CNP)When a credit or debit card is not present for the payment transaction. Most often used in the eCommerce environment. transaction. These include algorithms that look for fraud and risk scoring behind the scenes of the online transaction.

For many years, merchants were at the forefront of creating and implementing their own risk-based assessments to improve online security. Many have also filled the void by using their own encryptionThe process of encoding a message so that it can be read only by the sender and the intended recipient and tokenizationTokenization is the process of replacing one number with another unrelated number. solutions. Now, with the meteoric rise of online transactions, the payments ecosystem is saturated with various solution providers centered around making online transactions safer and more efficient. Merchants can choose from a variety of fraud solution providers, token service providers, orchestraters, omnichannel solutions, gateways, and other vendors to fit their business needs with online channels.

Card Present (CP) v. Card Not Present (CNP)

Now, that eCommerce is a core channel of commerce for businesses, merchants look towards growth and maintenance of eCommerce practices. There are several security features that allow us to know more about a customer in the eCommerce space that we do not know in-store, which results in a more secure environment. Additionally, there are different security technologies to mask and secure data in an online environment that have been tried and tested.

“A merchant needs to know that users, internal or external, are who they say they are, and that they have permission and the funds available to make purchases.”

Historically, merchants have paid higher fees on eCommerce (CNP transactions) despite having

to bear the majority of fraud losses on those transactions. Nowadays, online and mobile

commerce can be a more efficient platform to shop in, and thusly, card acceptance should not

be nearly as costly. The truth, however, is the opposite. Merchants faced increases in fees for

online credit card transactions in 2022, leading to an almost 10 percent increase in the costs of

those transactions.

More Than 50 percent of All Fraud Losses Worldwide are Tied to CNP Transactions. However, CNP Volume Accounts for Less than 15 percent of Total Volume Worldwide.

– NILSON REPORT, 2018

The changing payments landscape where a customer might choose to buy something online

and pick it up in-store or purchase an item in-store using a web-based mobile phone application

is blurring the lines of CP vs. CNP. As commerce evolves, the paradigm between CP vs. CNP

payments also needs to transform. In the 2020s, we may see a complete refocus of retail

commerce to some form of omnichannel function, with Buy Online, Pick up In Store (BOPIS),

returns of goods, mobile apps, and Buy Now, Pay Later (BNPL) growing industry-wide.

Security features

ECommerce security

The basic needs of web and regular brick-and-mortar card present security are similar. A merchant needs to know that users, internal or external, are who they say they are, and that they have permission and the funds available to make purchases.

Sometimes when you visit a website, you have the ability to store your credit card information or set up a recurring payment (i.e., for utilities). In this instance, the merchant has your card-on-file and can make your next shopping experience more efficient by not requiring you to re-enter all your information. Credit card information is not stored in a readable format. It is always encrypted and passed through the merchant processing system. Over the past couple of years, stored information is often tokenized as well, which comes with opportunities and challenges for merchants with online spending.

Trending in Online Fraud

If the United States follows the same trends as the United Kingdom did following the transition to EMV chip cards – which only help mitigate counterfeit in-store, or card-present, fraud – online fraud is expected to continue to grow by a staggering amount, with some experts estimating as high as 300 percent, according to Internet Retailer, referencing a report by Aite Group.

“Merchants bear anywhere from 70 to 100 percent of all eCommerce fraud losses according to multiple Federal Reserve studies.”

Trending in Digital Fraud

According to a study by Juniper Research, North America is the largest contributor to the estimated $48 billion in global eCommerce fraud in 2023, at 42%, despite representing less than 7 percent of banked individuals globally. Also, the growth of BNPL in the 2020s is contributing to additional eCommerce fraud growth.

Who pays for fraudulent eCommerce activity?

Merchants bear anywhere from 70 to 100 percent of all eCommerce fraud Fraud that exists in the eCommerce space., losses according to multiple Federal Reserve studies.