Future of Payments

What you need to know:

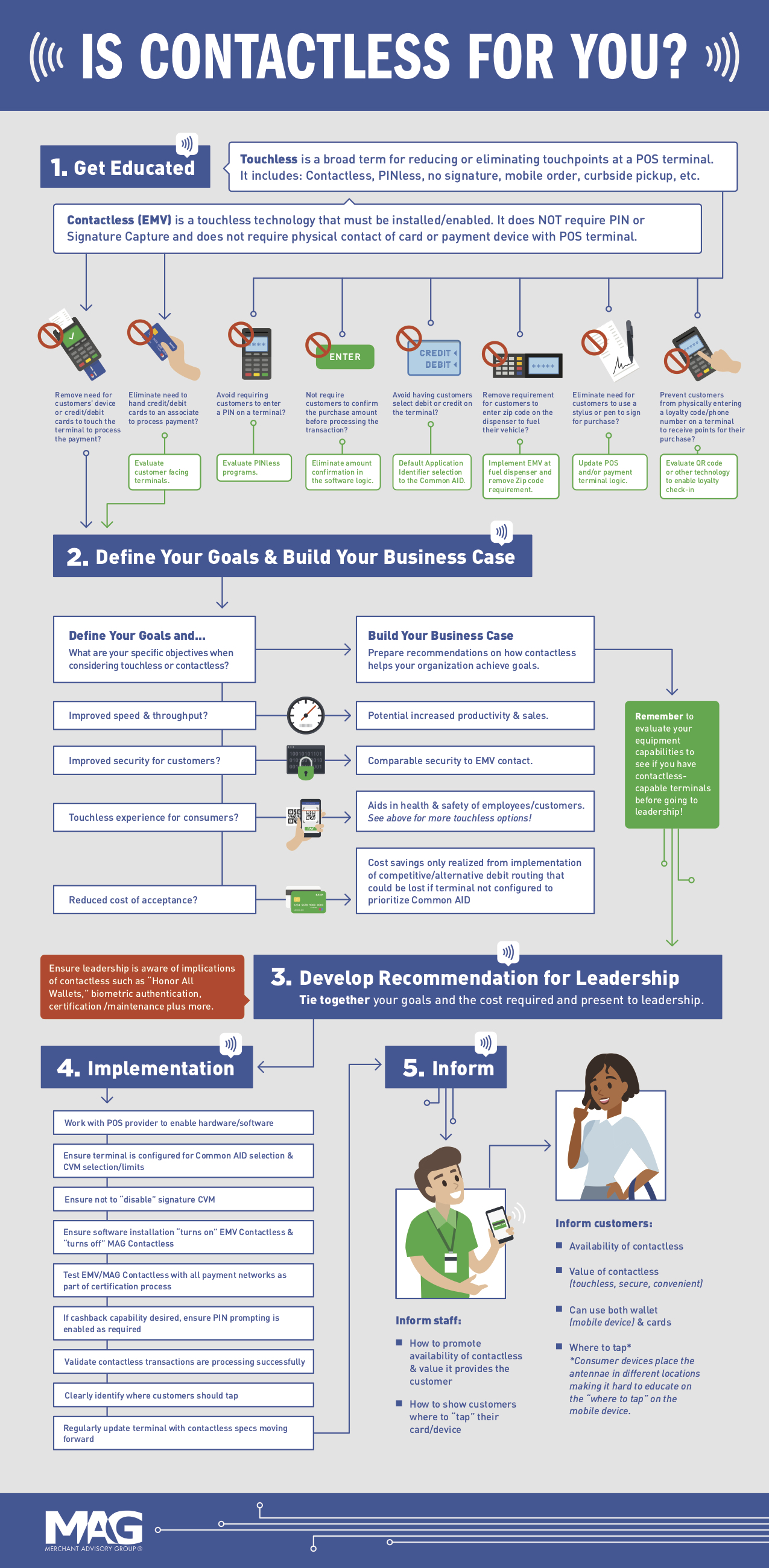

Technology is evolving at a rapid pace, resulting in the introduction of new and emerging payments products, such as those offered as part of touchless solutions and real-time payments, among others.

FAQ

Touchless:

What are touchless payments?

Touchless payments are transactions that reduce touchpoints at the point of purchase interaction. Examples may include QR codes, contactless (NFC), PINless, no signature, mobile order and pay, curbside pick-up, buy online and pick-up in store (BOPIS), and delivery.

Contactless:

What is contactless?

Contactless is a technology that must be installed and enabled, both on cards or in mobile devices and at the point of sale. Contactless does NOT require physical contact of a card or payment device with the POS terminal, but due to the installation and enablement, it does require preparation, planning, programming, testing and certification. Contactless also allows for PIN or PINless (i.e., no CVM).

I’ve heard the term “NFC” – what does it mean?

NFC is a payments industry term that stands for Near Field Communication, or the technology that enables contactless payments by transmitting payment data over short distances through radio waves.

Is mobile ordering considered contactless?

No, order-ahead functionality is an example of a touchless experience. Since Contactless is a specific technical implementation that passes payment information through radio waves over short distances, mobile ordering would NOT be considered a contactless experience.

I want to eliminate my customers from having to enter their PIN – is contactless the answer?

Not necessarily. Contactless is a technology that can be implemented with or without PIN. However, from a customer experience standpoint, contactless without PIN entry is ideal. Several of the domestic networks offer PINless programs that allow merchants to take advantage of alternative routing solutions (and lower costs) without requiring the PIN whether contactless, a physical swipe or dip at the terminal. If implementing contactless, you need to ensure your terminals are configured to first prioritize the Common AID which allows for alternate routing. Second, terminals must be enabled for PINless to avoid PIN prompting to the consumer.

Are there other considerations with respect to contactless acceptance?

Yes, merchants need to consider all aspects of payments acceptance when contemplating contactless acceptance. For instance, merchants may consider card networks’ honor all cards, or honor all wallets, rules and how those requirements factor into accepting contactless payments, as well as how tokenization solutions play into the overall customer experience.

“MOBILE PAYMENTS AND INTERNET PAYMENTS ARE SOME OF THE FASTEST GROWING SEGMENTS OF U.S. COMMERCE.”

Mobile:

The current environment has led to increased eCommerce and mobile payments adoption in the U.S., and they are some of the fastest-growing segments of U.S. commerce. Mobile payments may include, but are not limited to, touchless and contactless transactions.

What are mobile payments?

According to the U.S. Federal Reserve Consumer and Mobile Financial Services Report, mobile payments are defined as “purchases, bill payments, charitable donations, payments to another person, or any other payments made using a mobile phone. You can do this either by accessing a web page through the web browser on your mobile device, by sending a text message (SMS), or by using a downloadable app on your mobile device. The amount of the payment may be applied to your phone bill (for example, Red Cross text message donation), charged to your credit card, deducted from a prepaid card, or withdrawn directly from your bank account.”

How does the cost of a mobile payment differ from a card payment?

There are potentially tremendous cost efficiencies to be gained in the migration to mobile commerce where there is better technology and better security available for payments. However, there is also potential for the current high costs of card acceptance to be carried over into mobile commerce – with potentially new fees from new system participants. Currently, the cost of mobile payments follows the traditional cost structure in market implemented through the payments networks as either card present (NFC) or card not present (QR code, browser-based, or in-app on the mobile device) versus a specific cost structure for mobile.

Faster Payments:

How fast do payments move today?

It takes anywhere from one to three days for most payments to move through the transaction process today. The authorization happens almost instantaneously, but the movement of funds from the card issuing bank to the merchant’s bank account is a slower process. Other countries, such as the U.K., have already moved to real-time payments.

What is an ACH payment?

ACH stands for Automated Clearing House. ACH payments result in the purchase being deducted from an existing bank account.

How long does it take refunds or holds to become available to the consumer?

It can take anywhere from one to seven days for a refund to clear back into a consumer’s checking account or be credited to their card account statement. When funds are pre-authorized for items like a restaurant tip or hotel reservation, holds are placed on those funds. Sometimes it takes several days for those holds to be released by the cardholder’s bank.

Where is the U.S. headed in the short term?

The Federal Reserve announced it will stand up FedNow, a real-time payments system. FedNow soft-launched in 2023 and will continue rolling out its capabilities to more banks and providers in 2024. The Clearing House’s Real Time Payments Network (RTP) also offers financial institutions faster payments options. Merchants believe choice and transparency in real-time payments services will drive competition in the entire payments system, helping to bring the U.S. payments system in line with others around the globe.

Additionally, there are technology companies who, if allowed better opportunities to enter the marketplace, could significantly improve the speed and efficiency of U.S. payments.