Routing Basics

Smart Routing: The Highway to increased competition in the debit marketplace

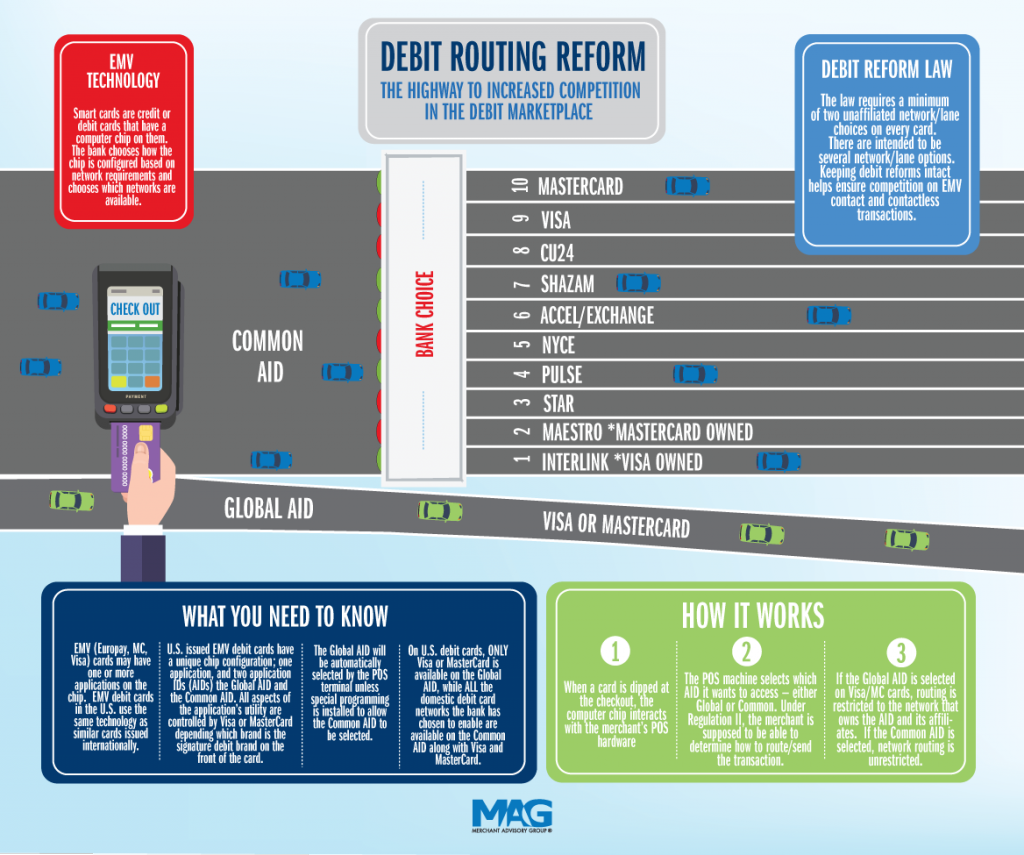

Current debit reforms require competition for network routing services to be made available on every debit card, including debit cards stored in digital wallets. Network routing is the behind-the-scenes technology dictating how information about a debit transaction is sent between payment system stakeholders.

Prior to debit reforms, there was no choice and no competition for these network routing services on roughly half of all debit cards in the marketplace. Signature debit card providers – Visa and MasterCard – were striking deals with the largest card issuing banks to make their networks the exclusive and only options for transaction routing services on a given debit card.

This practice created significant market inefficiencies that increased debit swipe fee prices to businesses and consumers. It also greatly inhibited the ability of domestic debit networks, who have a better track record on security, to compete for both issuer and merchant business.

Here’s how debit reforms have changed debit routing on magnetic stripe transactions. EMV smart chip routing is similar, but still has some significant barriers to competition.

FAQS ABOUT EMV ROUTING

How is a debit card EMV chip set up?

- Chip cards are credit and debit cards that have a computer chip on them. The bank that issues the card chooses how this chip is configured. EMV cards are the type of smart cards that have proliferated in the U.S.

Who manages and controls EMV technology?

- EMV is a closed technology, and EMVCo manages and controls EMV technology schema. The EMVCo Board of Managers consists of the six major global card networks – Visa, MasterCard, American Express, Discover, UnionPay, and JCB. Learn more about EMV here.

How is a debit card EMV chip set up?

- EMV cards have an EMV application on the chip. Think of the EMV application as a file folder on a desktop computer. That EMV application has two separate folders inside that desktop file folder. The two separate folders are called the Global AID and Common AID. On debit cards, Visa and Mastercard are available on the Global AID, while all the other domestic debit networks, such as NYCE, STAR, PULSE, and SHAZAM, are ONLY available on the Common AID. Visa and Mastercard, as well as the Visa-owned Interlink and Mastercard-owned Maestro brands, are also available on the Common AID.

How does debit routing for an EMV card work?

- When a customer inserts or taps their EMV debit card into a point-of-sale (POS) machine, the computer chip interacts with that POS equipment. That interaction determines, among other things, how the transition will be sent or routed. First, the POS machine must determine which AID – the Global or the Common – it is going to access. Once that choice is made, only the networks available on the selected AID are available for the merchant to send or route the transaction over.Visa rules require card issuers to prioritize the Global AID, which means it becomes the default option in the interaction between the computer chip and the POS machine. In order for the merchant to get access to routing rights, the retail point-of-sale logic essentially has to “break” default EMV processing. The merchant can do so by programming the POS to select the Common AID, which enables transaction routing options to all networks on the card instead of the issuer-prioritized Global AID. If the Global AID is selected, the only routing option is either Visa or Mastercard depending on which brand is on the front of the card.The U.S. EMV set-up creates unnecessary technical barriers to routing choice by segregating domestic networks onto the Common AID instead of putting all the network options on one AID. This technology set-up resulted in a more complex EMV deployment than in other markets, which in part led to longer certification timelines and delays in getting EMV to market in the U.S.

Why is routing choice important on EMV debit transactions?

- Routing choice and competition create a safer, more secure, and more efficient platform for U.S. payments to the benefit of U.S. businesses and consumers. Furthermore, closed technology deployments, such as the U.S. EMV transition, threaten the viability of U.S. domestic debit networks – networks that have a better track record on security than the global brands.

What needs to be done to preserve debit routing choice on EMV?

- The continued segregation of the Global and Common AIDs in EMV is an inhibitor to a level playing field. One way to resolve this would be to allow all networks equal access on the chip instead of dividing the chip into two separate file folders or pathways as described above. Combining all networks on a single AID would also improve international interoperability of U.S. EMV debit cards to the benefit of U.S. cardholders. This would also lay the groundwork for future regulations around routing in the U.S., for example, the Credit Card Competition Act of 2023, which could bring routing to credit cards. A unified and accessible AID would make implementing this regulation much more fluid for merchants and issuers.Additionally, any card network rules or technology specifications that require any stakeholder to prioritize the Global AID need to be altered to prioritize the Regulation II-compliant Common AID. Visa changed some of their operating rules pursuant to a late 2016 FTC investigation of these practices, as well as clarification [§ 235.7 Network Exclusivity and Routing Provisions, Q4] from the Federal Reserve that networks cannot inhibit merchant routing choice. This is one step in the right direction.It is critical that debit routing choice on EMV transactions is supported in digital environments – mobile, eCommerce, and interconnected payments – to ensure competition and innovation will thrive in those environments. The clarification of Regulation II in October of 2022 looks to address this and ensure that competition remains consistent across channels, but there are still potential barriers through the use of new tokenization solutions and other innovations that mask the permanent account number (PAN) from merchants. One area already riddled with competitive concerns is the failure of the EMVCo owners to license domestic debit networks access to EMV transactions initiated through biometric fingerprint technology; this needs to change in order for those digital solutions to be in compliance with the dual routing requirements in the law.

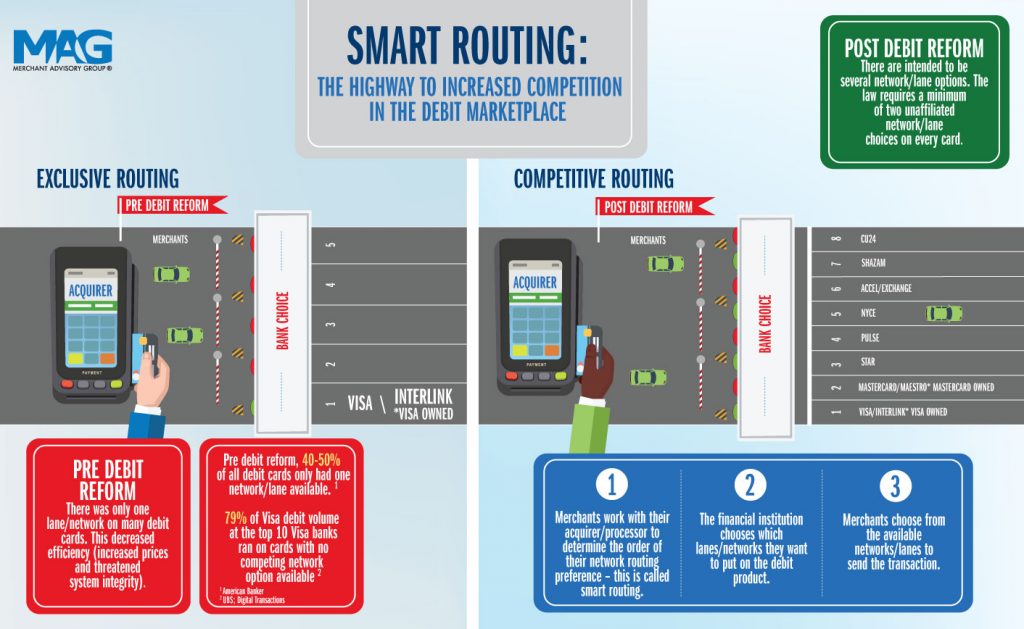

Debit Transaction Routing on Magnetic Stripe Cards: Pre-Debit Reform vs. Post Debit Reform

FAQS About Routing

Pre-debit reform, 40% to 50% of all debit cards only had one network available for routing transactions. 79% of Visa debit volume at the top 10 Visa banks ran on cards with no competing network option available.

What is debit reform trying to solve?

- Before the 2010 debit reforms, there was only one network available on many debit cards. This decreased efficiency, increased prices, and threatened system integrity.

According to a J.P. Morgan analyst report, “About 50% of Visa’s debit cards [had] no second unaffiliated network,” in 2010.

What did debit reform accomplish?

- Debit reform requires competition for network routing on every transaction.

- The law requires banks to put only a minimum of two unaffiliated network choices on every card, although, the intent is for robust competition with multiple network options.

- The debit reform law prevents Visa and Mastercard from striking exclusive bank deals that result in zero competition for network routing services.

- The law ensures merchants have a choice between at least two networks over which to send a transaction. This enables merchants and acquirers to do “smart” routing to the most efficient and economical network.

- The law ensures that every debit card has a backup network over which a debit transaction can be sent if one of the networks on a card is not working or has been compromised by hackers.

Does the law limit bank choice?

- No, it does not. A bank still chooses which networks to do business with and which networks they put on their debit cards.

How does debit routing work?

- Debit routing is done when there are multiple debit networks on a card as opposed to exclusive routing where there is only one available network over which to send a transaction.

- Debit routing is when a merchant works with their acquirer/processor to determine the order of their network routing preference. Some merchants are more involved in this decision-making than others based on size and resources.

- Debit routing services are offered by acquirers as a competitive business service to merchants of all sizes.

What are the benefits of debit routing?

- Debit routing makes the marketplace more efficient and more secure.

- Debit routing helps ensure domestic debit networks – who have a better track record of fighting transaction-level fraud than Visa and Mastercard – are available networks on more debit cards.

- Debit routing helps ensure consumers can use their debit cards if a network goes down or is hacked since there is a back-up network on every debit card.

- Debit routing gives merchants and acquirers an opportunity to send transaction routing services to the most economical network with the lowest fees.

- Competitive routing preserves competition for U.S. domestic debit networks.

How has routing competition already benefitted consumers?

- Visa’s roadmap for the U.S. EMV smart chip technology had a confusing customer-facing checkout screen that required a customer to choose between “Visa Debit” and “U.S. Debit.” Both the Federal Reserve and the Federal Trade Commission challenged this approach, and Visa conceded to change their EMV deployment rules; however, consumers may still see “Visa Debit” and “U.S. Debit” prompts if old POS software is used.

- Without the law in place, merchants would have had limited recourse against the screens, and Visa could have continued to impose this unsatisfactory customer experience on merchants and shoppers.

- Allowing Visa, through their network rules, to inject themselves into the way businesses manage their checkout experience is intrusive to the merchant and bad for the customer. The law protects against this anti-competitive behavior for transaction routing.

Why is routing competition important for innovation?

- Competition provides opportunities for new stakeholders to get a foot into the marketplace, such as the development of PINless technology which allows for debit routing without PIN entry and opens multiple channels to routing competition.

- Competition from new business partners means the opportunity to work with providers who offer more efficient, secure, and faster payments for in-store, online, and mobile commerce.

- Routing competition opens up the highway to free-flowing traffic instead of creating a single-lane bottleneck.